Know You Should Have A Budget, but Don’t Want to? Budgeting for Beginners

Hate budgeting? These simple steps will help you setup a beginners budget. Ready to dive in?

I’m so excited to welcome Melissa Berry to Whimsicle today. You can find her over at the Sunburnt Saver where she blog about budgeting, paying off debt, and frugal living. She’s paid off a lot of debt and still have a lot to go, but still wants to live a normal, happy life – on a budget. This basically means she’s pretty much an expert at building functional budgets that still incorporate fun!

If you’ve been struggling with budgeting, I’m with you: I hated budgeting for a long time. I felt like budgeting was a punishment and a waste of time. It took me longer than I’d like to admit that budgeting wasn’t punishment, but rather freedom – yes, freedom! By creating a functional budget for my family, I’ve been able to reduce our expenses on things we don’t care about, and increase spending on things that matter to my family.

Here’s how to get started setting up a functional, family-friendly budget. This shouldn’t take you more than 30 minutes to do, and you could even set up a budget date with your spouse to do it together (yay, romantic!)

Monthly Budgeting Vs. Weekly Budgeting

Overall, you’ll look at your budget from a monthly viewpoint. This is the standard way most people think of budgeting: how much did we bring in (income) this month and how much did we spend this month?

I’d like to encourage you to also look at weekly budgeting. This is a really good way to budget if this is your first budget or if you don’t like budgeting (like I do!) Yes, if you don’t like budgeting, you should look at your budget more frequently! 😃

Next, decide if you want to do a pen and paper budget, an Excel (or Google Sheets) budget, or an app-based budget. Personally, I’m all about efficiency, so I like to use an app-based budget, like Mint.

It’s super easy to get started on Mint, you really just need to connect your bank account and the credit cards you use. Mint has a secure connection with banks and credit unions, so you’re in good hands.

No matter what you use, be sure to go through at least two month’s worth of transactions (that means money going in and out) to get a good overall picture of your budget. Then, if you’re using an app like Mint or building your own budget, start breaking your budget out into categories.

Building Your Budget

Now that you’ve looked over your spending for the past 2 or more months, you probably are starting to get a feel for which “categories” you spend the most on. It’s time to break out those categories!

You’ll want to stay high-level when building your budget, and here are some suggestions for how to structure your budget:

- Mortgage/rent

- Utilities

- Car payments/insurance

- Debt payments (credit cards, student loans)

- Groceries

- Entertainment

- Gas (for your car)

- Home supplies (tissues, toilet paper, soap)

- Kids

- Pets

Try to avoid having a Miscellaneous category as much as possible! It’s too easy to lump things, like “Girl Scout Cookies” into Miscellaneous, but avoid it. Either call them Groceries or call them Personal Care – whichever category they really fall into 🙂

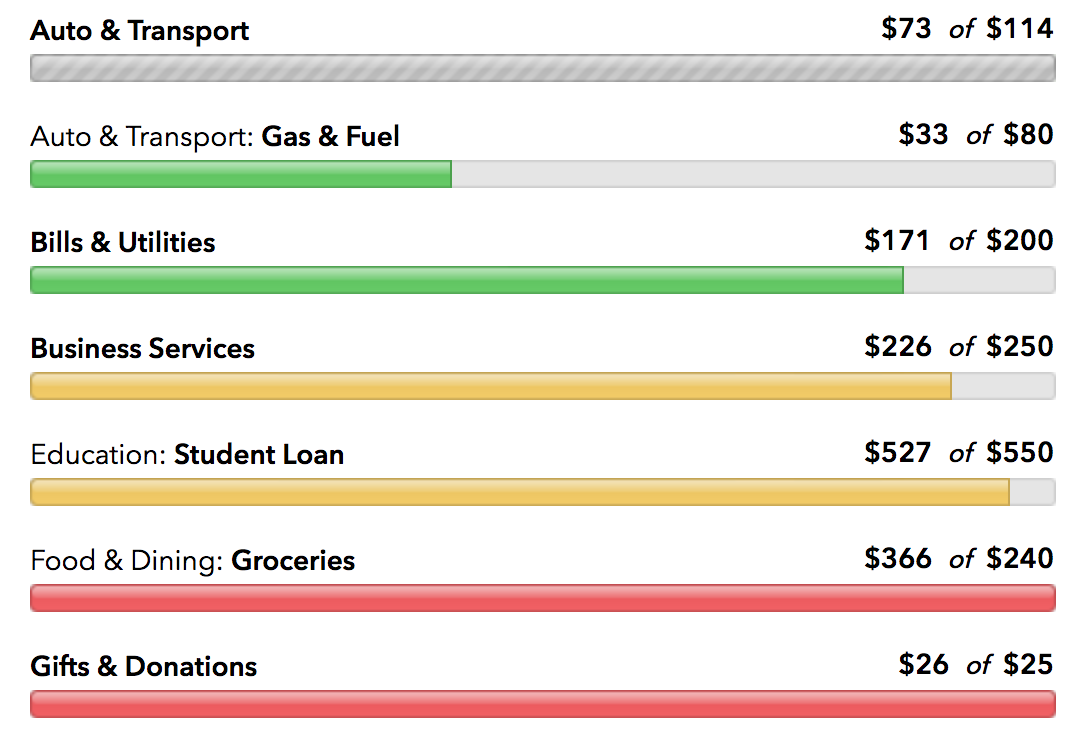

If you’re using Mint, Mint will begin to identify your transactions and categories those expenses for you, which will save you time! Here’s a screenshot of what a portion of my Mint budget looks like:

Please don’t judge on the groceries, January was a super hard month and my husband had the flu… so I ended putting all the DayQuil/Nyquil, cough drops, soup, more tissues, etc. in the “Groceries” category! :-/ Business Services is a category since I run my own business, but you may not have that category.

Making Your Budget Work for You

Once you have your budget categories set, it’s time to determine how much money you want to allocate to them monthly. Basically, this comes down to two things: your income and your priorities.

Your income will have the biggest impact on your budget: if your income is lower, you’ll have to reduce your monthly expenses on everything. But this doesn’t mean you have to deny yourself fun! Your “personal care” budget may just be $25 a month versus $200. Conversely, if your income is higher, you may be able to spend a little more on “personal care” (like massages, getting your nails done, that barre class – anything that makes you happy!)

Your priorities will have the second biggest impact on your budget. List out your priorities: what do you want to spend the most on every month? Maybe eating organic food is really important to you, so Grocery is an important budget category to you and you allocate more money for it. On the other hand, maybe Entertainment isn’t as important to you, so that’s lower on your list of priorities – meaning you allocate less money to that monthly budget category.

Allocate money from your income into monthly budget categories. Make sure to have a budget category for “saving” – you always want to make sure you have some emergency savings or, if you have an emergency savings fund, savings for travel, college, investing, etc.

Once you have your categories set and budget allocated, make it a point to check on your budget weekly. I do this every Sunday night, to review what I’ve spent so far and how it compares to my budget by category.

Obviously, in the example above, I’m way over in Groceries. However, as you can see below, I’m under in Personal Care, so I’ll keep in mind to spend less (or quit spending for this month) on Personal Care, so that can cover my overspending in Groceries.

Track Your Budget for a Month or Two

Once you see where your budget has been going, look at your priority list. Has your budget been reflecting your priorities?

If not, now you know for sure where your money is going and you can consciously remind yourself when you’re out – spend less on Entertainment or Home Supplies, for instance, so you can spend more on Kids and Grocery.

I personally prefer to use my credit card and then I check in on Mint once a week to make sure I’m on track, but others take out cash (called the “cash envelope system”) and put it in envelopes labeled “Grocery” or “Entertainment”. Once those envelopes are empty, you’re done spending!

Checking in on your budget weekly is important if you’re just getting started to budgeting and aren’t very good at sticking to your budget. I’ve been doing this for a while and I still check in weekly! Eventually, as you get better at knowing where your money regularly goes, you’ll only need to check in on your budget monthly.

Budgeting is a Process, But It’s Also Freedom

Every month, you’ll probably need to adjust a bit – maybe it’s soccer season and the kids need check ups, new cleats, registration fees, etc. Now that you have a budget, it’s as simple as going in and removing funds from Home Supplies, for example, and allocating that $50 to Kids. Budgeting isn’t “set it and forget it”, unfortunately, but once you get your budget down, it becomes so much easier and more freeing to do things.

I know once I took budgeting seriously, I stopped feeling nervous about every purchase, because I knew I had the budget for it. Yes, sometimes things get out of sync (like when people get the flu, twice!), but that’s part of budgeting. You’ll have great months and you’ll have bummer months, but stick to it and eventually you’ll have more great months than bad months – I promise!

Need some ideas for reducing your budget? Sign up for my email course, 4 Weeks to Crush Your Budget Challenge, where I’ll send weekly challenge emails on tackling the biggest budget busters, including Groceries, Entertainment, Gifts/Holidays and more.